Shell hands £4.7bn to shareholders as quarterly profits beat forecasts

Shell has revealed it is handing a further $6bn (£4.7bn) to shareholders after its latest quarterly profits beat its own forecasts.

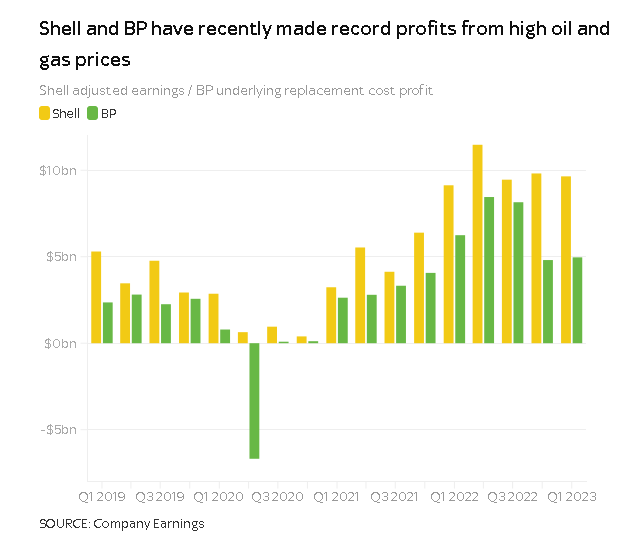

The oil and gas major reported net profits of $9.6bn (£7.6bn) for the first three months of the year.

The figure was slightly down on the sum achieved in the final quarter of 2022 but above the $9.1bn (£7.2bn) achieved in the same period a year earlier.

Its own estimate in advance of the first quarter earnings report had stood at $8bn (£6.3bn).

Shell said the performance reflected a cooling in oil and gas prices since the start of 2023 and higher taxes.

The headwinds, it reported, were partially offset by improved volumes and a better performance from fuel trading and its chemicals and products division.

Its rewards for shareholders - in dividends and share buy-backs - matched the amount handed back in the previous quarter.

Shell said the $4bn buyback programme was due to be completed by the end of the current second quarter.

The dividend of $0.2875 per share was the same as the amount paid for October-December.

While the profits made by the likes of Shell and BP, which revealed its figures earlier this week, are welcome for investors and pension funds alike, they have also prompted much debate over whether they should be paying more to the public purse through windfall taxes.

Shell said it took an accounting charge of $441m (£351m) relating to the Energy Profits Levy on its North Sea operations in the last quarter of 2022.

Its total liability for the last calendar year was $134m (£106.6m) - of which $57m (£45.3) was paid last year.

However, rebates meant the net charge stood at $8m (£6.3m).

Shell expects to pay over $500m (£400m) under the levy in 2023.

Chief executive Wael Sawan told investors: "In Q1 Shell delivered strong results and robust operational performance, against a backdrop of ongoing volatility, while continuing to provide vital supplies of secure energy.

"We will commence a $4bn share buyback programme for the next three months as part of our commitment to deliver attractive shareholder returns."

Shares rose by 3% at the open.